Stocks advance as investors weigh earnings, car tariff hopes

Stock markets mostly advanced Tuesday as investors assessed the impact of tariffs on corporate earnings and digested a report that President Donald Trump might spare automakers from some of his levies.

Wall Street opened mixed but all three major indices were higher in midday trading.

In Europe, the London FTSE 100 index and Frankfurt's DAX closed higher but the Paris CAC 40 ended in the red.

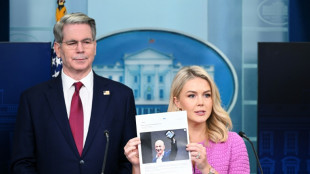

While the White House didn't launch any trade tirades against other countries, the White House slammed Amazon over reports it would soon tell consumers how much Trump's tariffs have contributed to the price tag on its goods, branding it a "hostile and political act".

"This is significant," said Kathleen Brooks, research director at XTB, noting that this was the first time the Trump administration has turned its ire towards a US company that questions its tariffs policy.

"Financial markets have been roiled by political interference in the global economy in recent weeks... if the Trump administration is now publicly accusing US companies of hostile acts if they disagree with the President’s US economic policy then this could stop the recent recovery rally in risky assets," she said.

Amazon later said it will not show tariff costs on products.

Shares in Amazon fell nearly two percent at the start of trading but recovered much of their losses during morning trading.

Investors were also weighing a Wall Street Journal report that the White House will spare automakers -- already facing 25-percent tariffs -- from further levies, such as those on steel and aluminium.

The move is aimed at making sure the various tariffs Trump has unveiled do not stack up on top of each other.

The news prompted US auto giant General Motors to push back its earnings conference call to Thursday.

It still released its earnings statement on Tuesday, showing its first-quarter profit fell 6.6 percent to $2.8 billion, though it was better than expected.

The US automaker also said it was re-examining its 2025 outlook in light of uncertainty over US tariffs.

GM shares were down more than two percent in midday trading.

In Europe, shares in Volvo Cars sank nearly 10 percent after it announced plans to cut costs by almost $2 billion, including through job cuts, as its profits fall.

"Tougher market conditions and lower volumes combined with increased price pressure and tariff effects are impacting profitability," Volvo Cars chief executive Hakan Samuelsson said.

Shares in German sportswear giant Adidas fell 2.8 percent as it warned that tariffs would increase prices for its products in the United States.

British pharmaceutical giant AstraZeneca said it has begun to move some of its European production to the United States, ahead of Trump's possible tariffs on the sector, helping its shares rise 0.9 percent.

In Asia, Hong Kong stocks advanced while Shanghai dipped after US Treasury Secretary Scott Bessent told CNBC that negotiations with China were ongoing but said that the ball was in Beijing's court.

Investors are also awaiting earnings from US tech titans this week, including Amazon, Apple, Meta and Microsoft.

There are also a number of economic data releases this week, with information released Tuesday showing US consumer confidence has fallen to its lowest level since the onset of the Covid-19 pandemic.

Oil prices fell further on Tuesday on fears that global trade tensions may lead to a slowdown in economic activity that would hamper energy demand.

- Key figures at 1530 GMT -

New York - Dow: UP 0.6 percent at 40,476.80 points

New York - S&P 500: UP 0.2 percent at 5,539.89

New York - Nasdaq: UP less than 0.1 percent at 17,376.81

London - FTSE 100: UP 0.6 percent at 8,463.46 (close)

Paris - CAC 40: DOWN 0.2 percent at 7,555.87 (close)

Frankfurt - DAX: UP 0.7 percent at 22,425.83 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 22,008.11 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,286.65 (close)

Tokyo - Nikkei 225: Closed for a holiday

Euro/dollar: DOWN at $1.1403 from $1.1424 on Monday

Pound/dollar: DOWN at $1.3404 from $1.3441

Dollar/yen: UP at 142.21 yen from 142.04 yen

Euro/pound: UP at 85.08 pence from 84.99 pence

West Texas Intermediate: DOWN 1.7 percent at $60.98 per barrel

Brent North Sea Crude: DOWN 1.7 percent at $63.69 per barrel

burs-rl/cw

A.Gruber--SbgTB